Sage accounting software vs QuickBooks is a common comparison that many business owners face today. If you’re looking for a tool to manage your money, track expenses, and stay organized, you’ve likely heard of these two. They’re both well-known, but they work in different ways. Some people like one for its simplicity, others choose the other for its advanced features. So, how do you know which one is right for your business?

What is QuickBooks, and How does it Work?

QuickBooks is accounting software built for business owners who want a clear view of their money. It helps you track income, record expenses, send invoices, and even run payroll—all in one simple system.

Many people start with QuickBooks Desktop, but later move to the cloud version for more flexibility. The QuickBooks Desktop to Online migration is common, especially for teams that want access from anywhere. The online version works on your browser or phone, so you don’t have to be in the office to check your books.

Everything is saved in the cloud, which means your data is safe and updates automatically. You can connect your bank, payment apps, and tools like PayPal or Stripe. QuickBooks pulls in that info and shows you easy charts and reports to help you understand where your money goes.

If you’re looking for a simple way to manage your business finances, QuickBooks Online is a great option—and moving from desktop to online is easier than most people expect.

What is Sage Accounting, and How does it Work?

Sage Accounting Software is a tool made for businesses that need more control over their finances. It helps you handle invoices, track expenses, manage inventory, and run reports—all from one system.

While QuickBooks is often used by smaller businesses, Sage is commonly chosen by companies with more complex needs. If you manage projects, track jobs, or need detailed reports by department, Sage can handle that.

Sage works both as a cloud-based solution and as a desktop program, depending on the version you choose. The online version lets you log in from anywhere, while the desktop version gives you more control over your data setup.

Many users like how Sage handles things like job costing, inventory management, and multi-user access. It also has features for industry-specific needs, like construction or manufacturing.

If you’re looking for accounting software that goes beyond the basics and lets you dig into the details, Sage Accounting might be the better fit for your business.

Key Differences Between QuickBooks and Sage?

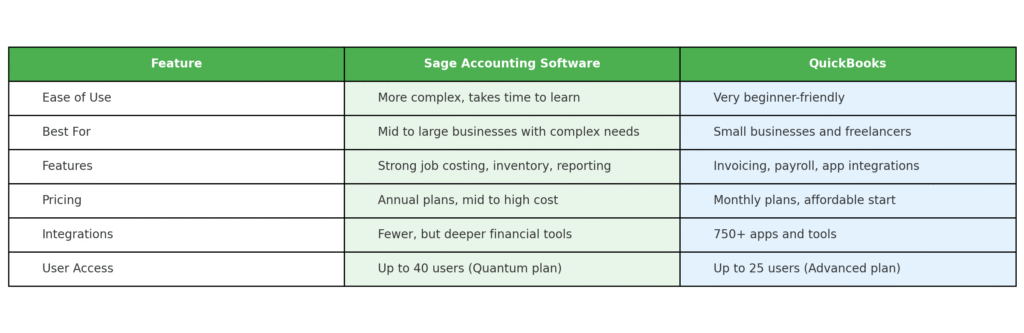

When looking at QuickBooks and Sage Accounting Software, the differences come down to how each one works and who they’re made for. Here’s a simple breakdown:

- Ease of Use:

QuickBooks is easier to learn and use, especially for beginners. Sage has more tools, but takes time. - Features:

Sage includes things like job costing, inventory tracking, and industry-specific reports. QuickBooks keeps things simple and user-friendly. - Pricing:

QuickBooks uses monthly pricing. Sage often requires an annual payment, which may cost more upfront. - Integrations:

QuickBooks Online connects with over 750 apps and tools. Sage offers fewer integrations but goes deeper in financial control. - Best Fit:

QuickBooks is ideal for small businesses and freelancers. Sage works better for larger businesses or those with complex needs.

QuickBooks Pros and Cons

Like any tool, QuickBooks has its good sides and not-so-good sides. Let’s go over both so you know what to expect.

Pros of QuickBooks:

- Very easy to use, even if you’re not an accountant.

- Great for small businesses, startups, and solo owners.

- Clean dashboard with helpful charts and summaries.

- Cloud-based with access from any device, anytime.

- Over 750 app integrations, including banks, PayPal, and more.

- Built-in payroll and time tracking options.

- QuickBooks Desktop to Online migration is smooth if you want to switch.

Cons of QuickBooks:

- Advanced features are only in higher-priced plans.

Some features, like inventory or job costing, are limited. - Extra costs for payroll, add-ons, or more users.

- It may not be the best fit for large or complex companies.

If your goal is to keep accounting simple and mobile, QuickBooks is one of the top choices out there.

Sage Accounting Pros and Cons

Sage Accounting Software gives you more control, but it also asks for a bit more from the user. Let’s take a closer look at the good and the not-so-good.

Pros of Sage Accounting:

- Offers strong tools for job costing, project tracking, and inventory.

- Great for companies in construction, manufacturing, or services.

- Can handle multi-user access and more complex workflows.

- Detailed financial reporting options for deeper insight.

- Supports multi-currency and industry-specific needs.

- Available in both desktop and cloud versions.

Cons of Sage Accounting:

- Takes longer to learn and set up, especially for new users.

- Fewer app integrations compared to QuickBooks.

- Annual pricing may feel high for small businesses.

- Support options can vary by version and plan.

If your business needs advanced accounting tools and you don’t mind a learning curve, Sage might be the better choice.

Sage Accounting Software vs QuickBooks: Which is Better?

Sage Accounting Software vs QuickBooks is a common question that comes up when choosing finance tools. The answer depends on what your business needs.

If you want a tool that is simple, easy to learn, and quick to use, then QuickBooks is likely the better choice. It’s made for small business owners who don’t want to deal with a complicated setup. It works well for freelancers, startups, and companies with basic accounting needs.

But if your business is growing and you need more control over projects, jobs, or inventory, Sage Accounting Software has more to offer. It’s a better fit for businesses that want to track detailed financial data, manage multiple users, and generate deep reports.

So, which one is better?

- QuickBooks is better for ease and speed.

- Sage is better for depth and control.

Neither is perfect for everyone. It all comes down to what your business does, what features you need, and how much time you’re willing to spend learning the system.

If you’re still unsure, talking to someone who knows both tools—like our team at Hundred MS—can make the decision easier.

Quick Recap: Sage Accounting Software vs QuickBooks

Conclusion

Sage Accounting Software vs QuickBooks is not a one-size-fits-all decision. Both are trusted, both are powerful, but they solve different problems for different kinds of businesses.

If your business is small, and you want something easy, fast, and clear—QuickBooks is a smart pick. You’ll spend less time learning and more time running your business.

If your business has more complex needs, like job costing or tracking many projects, Sage Accounting Software gives you more control. It may take longer to learn, but it offers tools that go deeper.

The key is to know what matters most to you—simplicity or depth, flexibility or structure.

Still not sure? You don’t have to figure it out alone. At Hundred MS, we help business owners choose the right tools, move their data, and set everything up the right way—from QuickBooks to NetSuite ERP and more.

Your accounting software should make life easier, not harder. Let’s make sure it does.

Frequently Asked Questions (FAQ)

Yes, switching from QuickBooks to Sage Accounting Software (or vice versa) is possible. Many businesses outgrow one tool and move to the other. If you’re using QuickBooks Desktop, a lot of users first go through a QuickBooks Desktop to Online migration before switching. It’s important to plan the move so your data stays safe.

Yes, QuickBooks Online is easier to set up and use, especially for beginners. It’s made for small businesses and people with little accounting experience. Sage Accounting Software is more advanced and might take longer to learn, but it’s powerful once you know how it works.

You can start on your own, but many businesses get better results with expert help. If you’re setting up things like payroll, reports, or NetSuite Accounting, it helps to work with a team like Hundred MS. We guide businesses through setup, training, and even NetSuite ERP implementation when they’re ready to upgrade.

If your business gets too big for either tool, it might be time to explore NetSuite ERP. It’s a more advanced system made for scaling businesses. At Hundred MS, we help companies move from QuickBooks or Sage to NetSuite, making sure everything runs smoothly.